-

Table of Contents

Revolutionizing Finance: Fintech Innovations in 2024

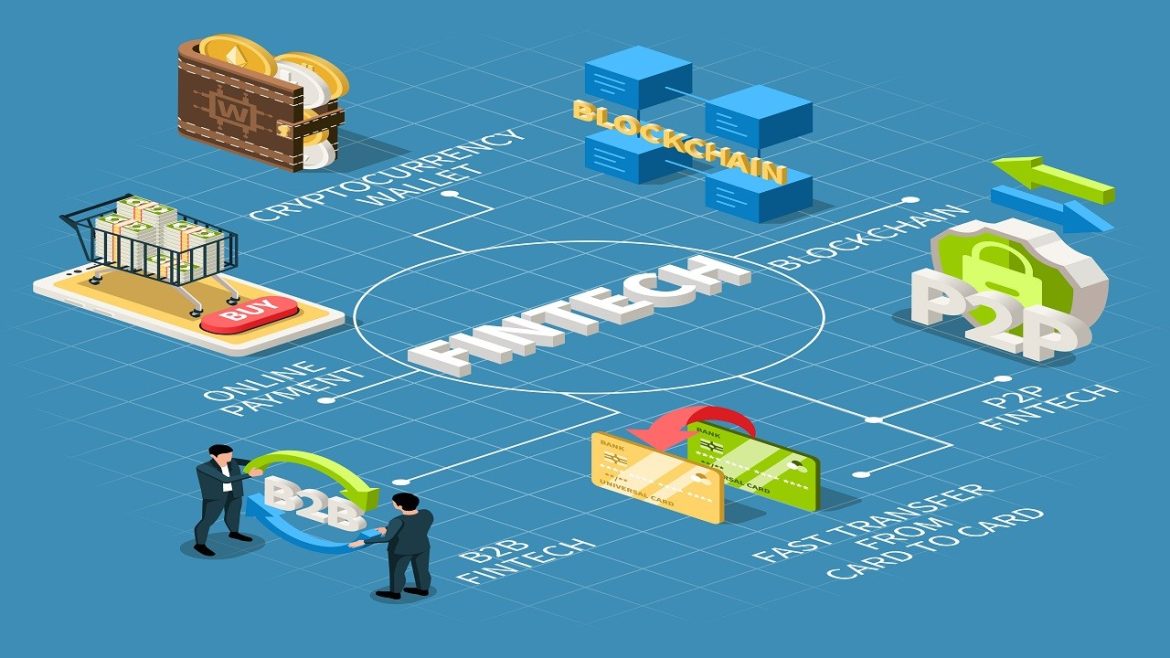

Fintech innovations have been rapidly transforming the traditional finance industry, and this disruption is expected to continue in 2024. With advancements in technology and the rise of digital platforms, fintech companies are revolutionizing the way financial services are delivered and accessed. From mobile banking and digital payments to blockchain technology and artificial intelligence, these innovations are reshaping the financial landscape, offering greater convenience, efficiency, and accessibility to individuals and businesses. In this article, we will explore some of the key fintech innovations that are set to disrupt traditional finance in 2024.

The Rise of Decentralized Finance (DeFi) and its Impact on Traditional Banking

The financial industry has undergone significant transformations in recent years, thanks to the rise of fintech innovations. One of the most disruptive trends in this space is the emergence of decentralized finance, or DeFi. This new paradigm is challenging traditional banking systems and reshaping the way we think about financial services.

Decentralized finance refers to a system that operates on blockchain technology, eliminating the need for intermediaries such as banks or financial institutions. Instead, transactions are conducted directly between users through smart contracts, which are self-executing agreements with the terms of the transaction written into code. This decentralized nature of DeFi offers several advantages over traditional banking.

First and foremost, DeFi provides greater accessibility to financial services. In many parts of the world, traditional banking services are limited or even non-existent. However, with DeFi, anyone with an internet connection can access a wide range of financial products and services. This inclusivity has the potential to empower millions of unbanked individuals and provide them with opportunities for economic growth.

Moreover, DeFi offers enhanced transparency and security. Traditional banking systems are often opaque, with customers having limited visibility into how their funds are being managed. In contrast, DeFi operates on a public blockchain, where all transactions are recorded and can be audited by anyone. This transparency not only builds trust but also reduces the risk of fraud and manipulation.

Another key advantage of DeFi is its ability to facilitate peer-to-peer lending and borrowing. In traditional banking, loans are typically issued by banks, which act as intermediaries between lenders and borrowers. This centralized model often comes with high interest rates and strict eligibility criteria. DeFi, on the other hand, allows individuals to lend and borrow directly from each other, cutting out the middleman and potentially lowering costs for both parties.

Furthermore, DeFi has the potential to revolutionize the concept of ownership. Through tokenization, real-world assets such as real estate or artwork can be represented as digital tokens on the blockchain. This opens up new possibilities for fractional ownership, where multiple individuals can invest in a single asset. Tokenization also enables greater liquidity, as these digital assets can be easily traded on decentralized exchanges.

However, despite its numerous advantages, DeFi is not without its challenges. One of the main concerns is the lack of regulation. Traditional banking systems are heavily regulated to ensure consumer protection and financial stability. In contrast, DeFi operates in a relatively unregulated space, which raises concerns about investor protection and the potential for illicit activities.

Moreover, the volatility of cryptocurrencies, which are often used as the underlying assets in DeFi protocols, poses a significant risk. The value of cryptocurrencies can fluctuate wildly, which can lead to substantial losses for investors. Additionally, the complexity of DeFi protocols and the potential for smart contract vulnerabilities make it susceptible to hacking and security breaches.

In conclusion, decentralized finance is disrupting traditional banking systems and reshaping the financial industry. Its decentralized nature offers greater accessibility, transparency, and security, while also enabling peer-to-peer lending, fractional ownership, and increased liquidity. However, challenges such as regulatory concerns and market volatility need to be addressed for DeFi to reach its full potential. As we look ahead to 2024, it is clear that DeFi will continue to play a significant role in transforming the way we think about and interact with financial services.

Exploring the Potential of Blockchain Technology in Revolutionizing Financial Services

Fintech Innovations: Disrupting Traditional Finance in 2024

The financial services industry has been undergoing a significant transformation in recent years, thanks to the rise of fintech innovations. These technological advancements have disrupted traditional finance and are reshaping the way we think about money and financial transactions. One of the most promising technologies in this space is blockchain, which has the potential to revolutionize financial services in 2024 and beyond.

Blockchain technology, originally developed as the underlying technology for cryptocurrencies like Bitcoin, is a decentralized and distributed ledger system. It allows for secure and transparent transactions without the need for intermediaries such as banks or clearinghouses. This technology has the potential to streamline and automate various financial processes, making them more efficient and cost-effective.

One area where blockchain technology is expected to have a significant impact is in cross-border payments. Currently, sending money internationally can be a slow and expensive process, with high fees and long settlement times. However, with blockchain, these transactions can be completed in a matter of minutes, with lower fees and greater transparency. This could greatly benefit individuals and businesses that rely on international transactions, making it easier and more affordable to send and receive money across borders.

Another area where blockchain technology could disrupt traditional finance is in the area of identity verification. Currently, individuals and businesses must go through a lengthy and often cumbersome process to verify their identities for various financial transactions. However, with blockchain, this process could be simplified and made more secure. By storing identity information on a decentralized ledger, individuals and businesses could have greater control over their personal data and reduce the risk of identity theft or fraud.

Furthermore, blockchain technology has the potential to revolutionize the lending and borrowing process. Traditional lending institutions often have strict requirements and lengthy approval processes, making it difficult for individuals and small businesses to access credit. However, with blockchain-based lending platforms, borrowers can connect directly with lenders, bypassing the need for intermediaries. This could open up new opportunities for individuals and businesses to access credit, stimulating economic growth and financial inclusion.

In addition to these specific use cases, blockchain technology has the potential to transform other areas of financial services, such as insurance, asset management, and supply chain finance. By providing a secure and transparent platform for transactions, blockchain can reduce fraud, increase efficiency, and lower costs across these industries.

However, despite its potential, there are still challenges that need to be addressed for blockchain technology to reach its full potential in revolutionizing financial services. These challenges include regulatory concerns, scalability issues, and the need for interoperability between different blockchain networks. Overcoming these challenges will require collaboration between industry stakeholders, regulators, and technology providers.

In conclusion, blockchain technology has the potential to disrupt traditional finance in 2024 and beyond. Its decentralized and transparent nature can streamline and automate various financial processes, making them more efficient and cost-effective. From cross-border payments to identity verification and lending, blockchain has the potential to revolutionize financial services and promote financial inclusion. However, addressing regulatory concerns and scalability issues will be crucial for the widespread adoption of blockchain technology in the financial services industry. As we look ahead to 2024, it is clear that fintech innovations, particularly blockchain, will continue to reshape the financial landscape and provide new opportunities for individuals and businesses alike.

Artificial Intelligence and Machine Learning: Transforming the Future of Financial Decision-Making

Artificial Intelligence (AI) and Machine Learning (ML) have been making significant strides in various industries, and the financial sector is no exception. In 2024, these technologies are set to transform the future of financial decision-making, disrupting traditional finance as we know it.

One of the key areas where AI and ML are revolutionizing finance is in risk assessment and management. Traditionally, financial institutions relied on manual processes and human judgment to evaluate creditworthiness and assess risk. However, with the advent of AI and ML, these processes have become more efficient and accurate.

AI algorithms can analyze vast amounts of data, including credit scores, financial statements, and even social media profiles, to assess an individual’s creditworthiness. ML models can then use this data to predict the likelihood of default or fraud, enabling financial institutions to make more informed lending decisions.

Moreover, AI-powered chatbots and virtual assistants are transforming customer service in the financial industry. These intelligent systems can understand and respond to customer queries in real-time, providing personalized recommendations and assistance. This not only enhances the customer experience but also reduces the need for human intervention, leading to cost savings for financial institutions.

Another area where AI and ML are reshaping finance is in investment management. Traditionally, investment decisions were made by human fund managers based on their expertise and market analysis. However, AI and ML algorithms can now analyze vast amounts of financial data, news articles, and market trends to identify investment opportunities and make data-driven decisions.

These algorithms can also learn from past investment performance and adjust their strategies accordingly, leading to improved investment returns. As a result, AI-powered robo-advisors have gained popularity, offering low-cost investment advice to retail investors and democratizing access to sophisticated investment strategies.

Furthermore, AI and ML are playing a crucial role in fraud detection and prevention. Financial institutions are constantly battling against sophisticated fraudsters who exploit vulnerabilities in their systems. AI algorithms can analyze patterns and anomalies in transaction data to identify potential fraudulent activities in real-time.

ML models can also learn from historical fraud cases and adapt their detection techniques to stay ahead of evolving fraud tactics. By leveraging AI and ML, financial institutions can significantly reduce fraud losses and enhance the security of their systems, protecting both themselves and their customers.

However, as AI and ML continue to advance, ethical considerations become increasingly important. The use of AI in finance raises concerns about privacy, bias, and accountability. It is crucial for financial institutions to ensure that AI algorithms are transparent, fair, and accountable, and that they comply with regulatory requirements.

In conclusion, AI and ML are transforming the future of financial decision-making in 2024. These technologies are revolutionizing risk assessment, customer service, investment management, and fraud detection in the financial sector. However, ethical considerations must be addressed to ensure the responsible and transparent use of AI in finance. As we move forward, it is clear that AI and ML will continue to disrupt traditional finance, shaping a more efficient, accurate, and inclusive financial industry.In conclusion, Fintech innovations are expected to continue disrupting traditional finance in 2024. These technological advancements have already transformed various aspects of the financial industry, including payments, lending, and investment. With the increasing adoption of digital platforms, artificial intelligence, blockchain, and other emerging technologies, Fintech is likely to further reshape the financial landscape, offering more efficient, accessible, and personalized financial services to individuals and businesses. However, this disruption also brings challenges such as regulatory concerns and cybersecurity risks that need to be addressed to ensure the sustainable growth of Fintech in the future.